The Bank of Ghana (BoG) has issued a one-month suspension of Taptap Send’s remittance services with commercial banks, Dedicated Electronic Money Issuers (DEMIs), and Enhanced Payment Service Providers (EPSPs) in the country.

The suspension, which take effect from November 8, 2024, is a response to regulatory violations involving a cedi remittance wallet operated by Taptap Send.

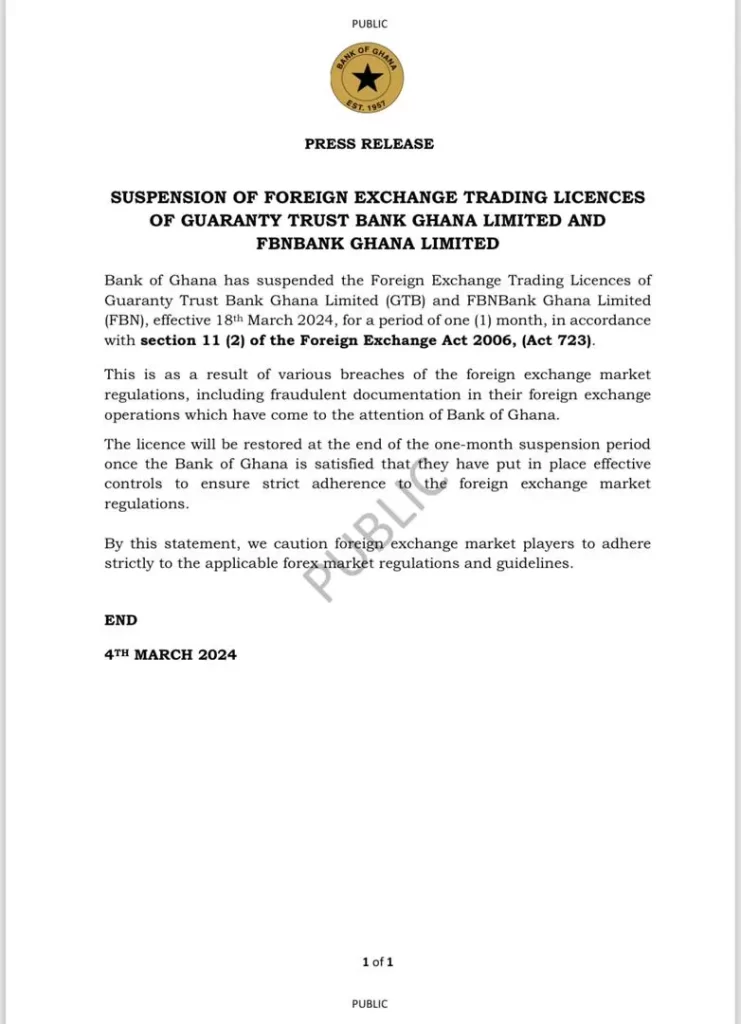

The BoG in a statement notes that the breach falls under Section 3(1) of Ghana’s Foreign Exchange Act, 2006 (Act 723), which requires businesses handling foreign exchange transactions to obtain a proper license.

Taptap Send is also accused of violating specific provisions within the Updated Guidelines for Inward Remittance Services, which set standards for the crediting of local settlement accounts and establish anti-money laundering (AML) and counter-financing of terrorism (CFT) protocols.

In a warning from its Financial Markets Department, the BoG noted that any further breaches could result in severe penalties for non-compliant institutions.